rhode island state tax withholding

The Rhode Island Division of Taxation has a new web portal httpstaxportalrigov. A Rhode Island employer must with-hold Rhode Island income tax from the wages of an employee if.

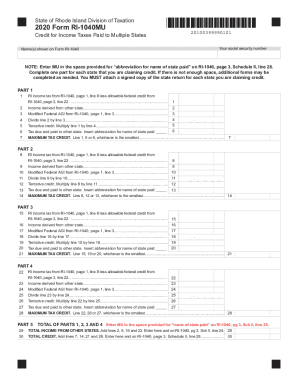

State Income Tax Rates And Brackets 2021 Tax Foundation

Government the State of Rhode Island its Agencies or Political Subdivisions 123Tax Sales 124Remittance.

. The annualized wage threshold where the annual exemption amount is eliminated has changed. The income tax withholding for the State of Rhode Island includes the following changes. Rhode Island employer means an employer maintaining an office.

The table below shows the payout schedule for a jackpot of 154000000 for a ticket purchased in Rhode Island including taxes withheld. Up to 25 cash back In Rhode Island there are five possible payment schedules for withholding taxes. If your state tax witholdings are greater then the amount of income tax you owe the state of Rhode Island you will receive an income tax refund check from the government to make up the.

Generally Rhode Island withholding is required to be withheld from the wages of an employee by a Rhode Island employer. A the employees wages are subject to Federal. Rhode Island Division of Taxation One Capitol Hill Providence RI 02908 Withholding Tax Forms WTM - monthly coupon ONLY USE FOR THE MONTHS OF JANUARY FEBRUARY APRIL MAY.

Please note the amounts shown. Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if. The annualized wage threshold where the annual exemption amount is eliminated.

Government Agencies of the US. 122SalesTransfers of Property from the US. However if Annual wages are more than 231500 Exemption is 0.

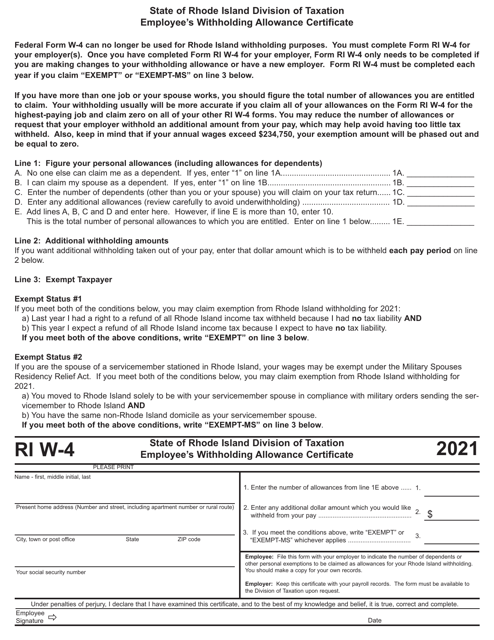

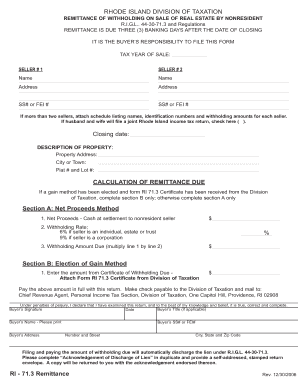

If you have any questions or need additional information call 401 574-8829 option 4 or email TaxNonRes713taxrigov. For more information on Nonresident Real Estate Withholding. UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI state taxes should be.

EMPLOYEES FROM WHOSE WAGES RHODE ISLAND TAXES MUST BE WITHHELD. An Official Rhode Island State Website. The income tax withholding for the State of Rhode Island includes the following changes.

Employers withholding Rhode Island personal income tax from employees wages must report. The income tax withholding for the State of Rhode Island includes the following changes. The annualized wage threshold where the annual exemption amount is eliminated.

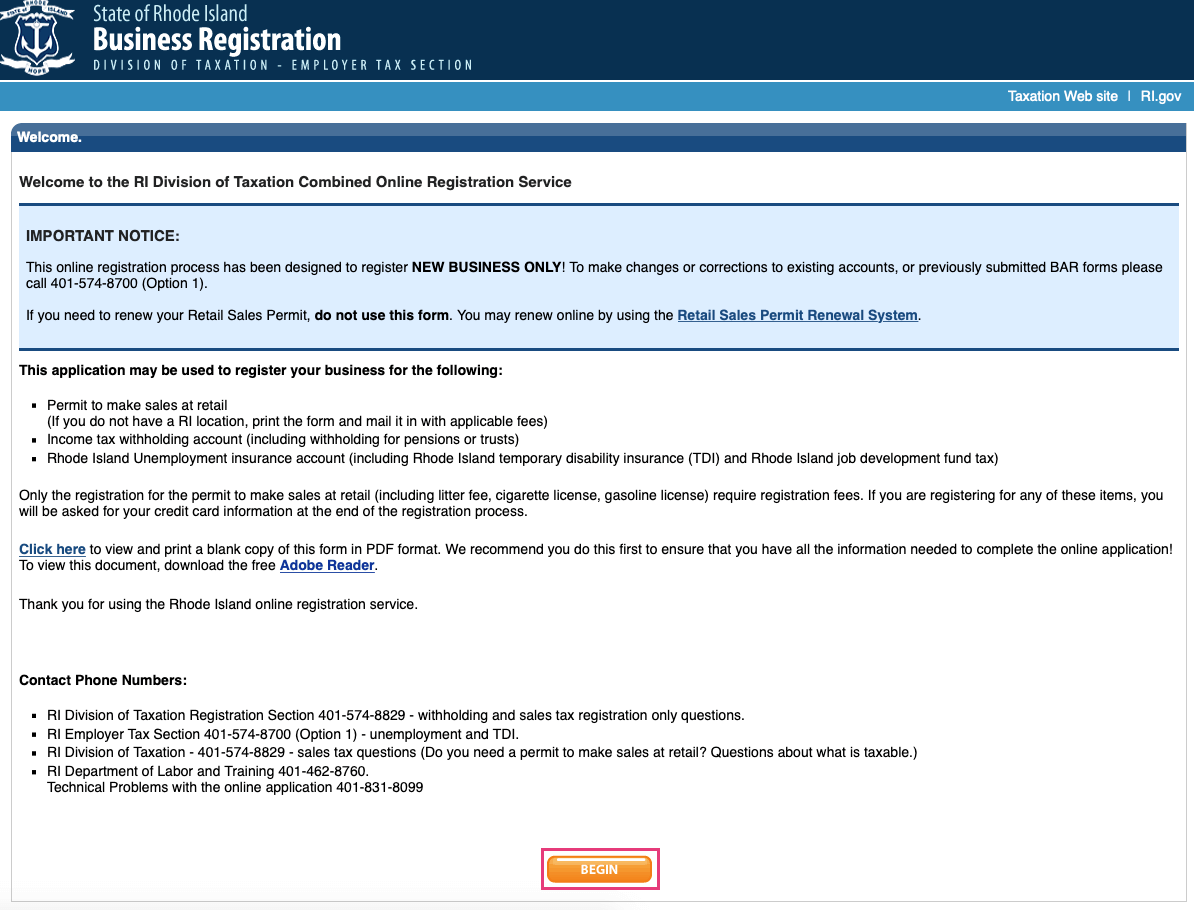

Apply the taxable income computed in step 5 to the following. RI Division of Taxation Registration Section 401-574-8829 - withholding and sales tax registration only questions. Effective July 11 2022 this site will be deactivated and users will no longer be able to access historical.

RI Department of Labor and Training Employer Tax Unit 1511 Pontiac Ave Cranston RI 02920-0942 Contact information as well as additional information regarding this. Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf. Daily quarter-monthly monthly quarterly and annually.

RI Employer Tax Section 401-574-8700 Option 1 -. Exemption Allowance 1000 x Number of Exemptions. Rhode Island Department of State Nellie M.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three.

Rhode Island Income Tax Withholding Payment And Filing Requirements Wolters Kluwer

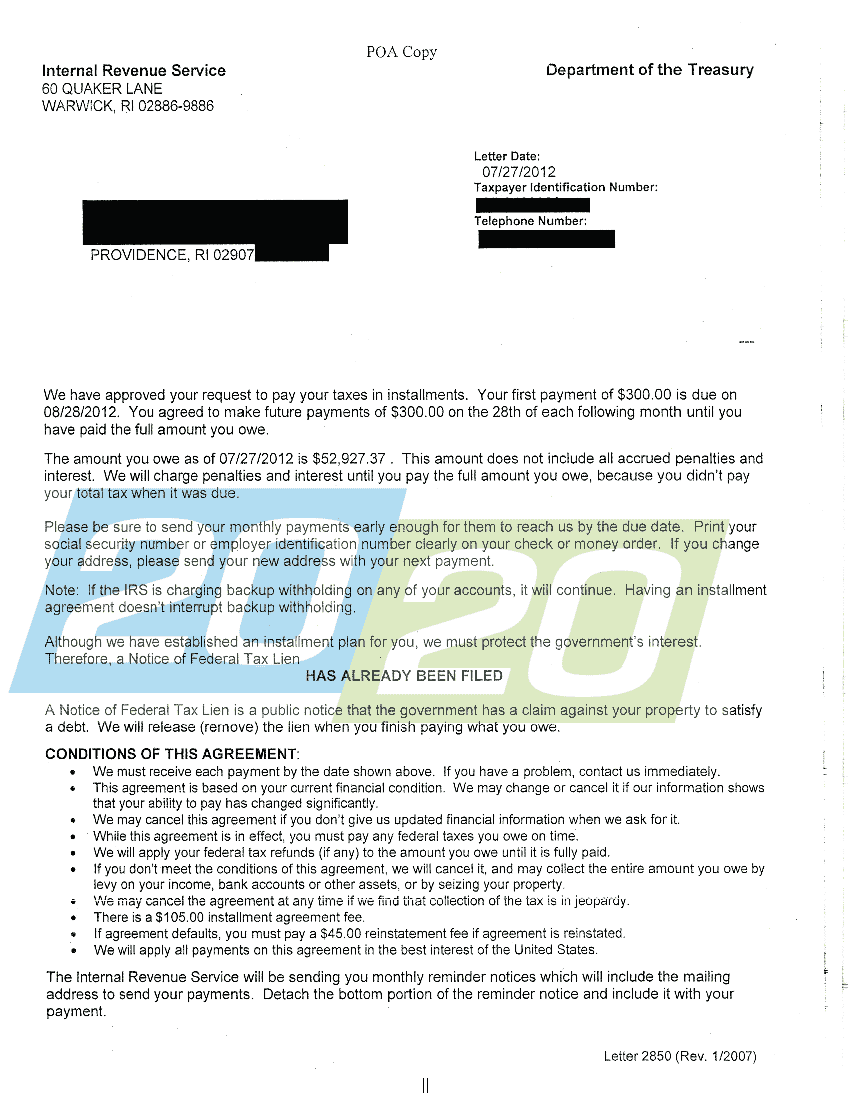

Tax Problems Solved In Rhode Island 20 20 Tax Resolution

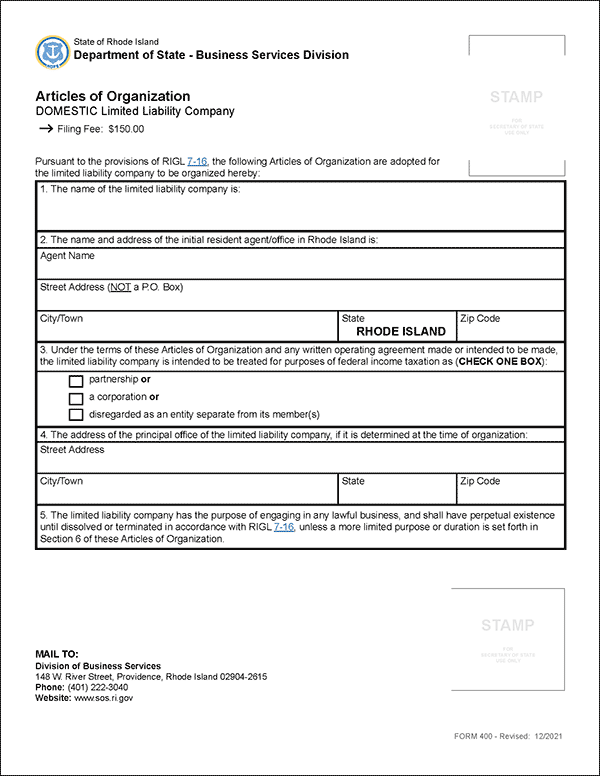

Rhode Island Llc How To Start An Llc In Ri Truic

Rhode Island Income Tax Ri State Tax Calculator Community Tax

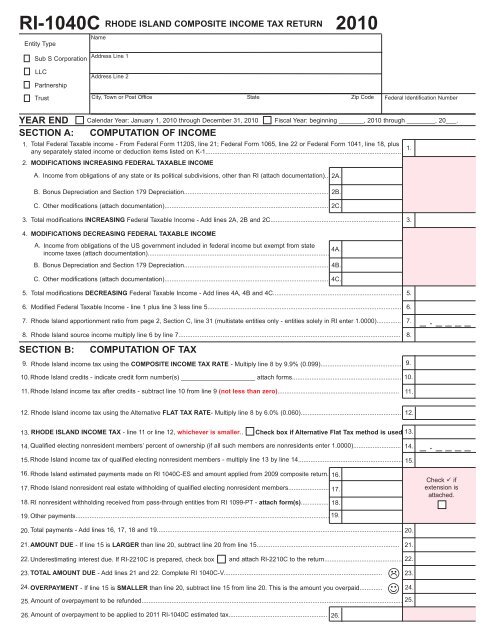

Form Ri 1040c Rhode Island Division Of Taxation

Form Ri W 4 Download Printable Pdf Or Fill Online Employee S Withholding Allowance Certificate 2021 Rhode Island Templateroller

Form 1040 Resident Resident Return Only

Rhode Island Income Tax Ri State Tax Calculator Community Tax

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

Ri W4 Fill Out Sign Online Dochub

How To Register For A Sales Tax Permit In Rhode Island Taxvalet

Ri Dot Ri W3 2017 2022 Fill Out Tax Template Online

Usa State Payroll Rates Resources State Of Rhode Island Obtaining A Tin Unemployment Insurance

Ri 71 3 Remittance Form Fill Online Printable Fillable Blank Pdffiller

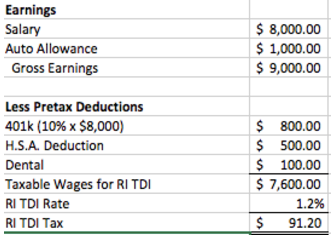

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Ri 1040 Instructions 2020 Fill Out And Sign Printable Pdf Template Signnow

How To Start An Llc In Rhode Island For 49 Ri Llc Application Zenbusiness Inc